Shelter from the Storm (Nexus Mutual)

Market driven responses to crypto's risks. A brief history of insurance as a support for commerce. The rise of the DeFi insurance collective. And one damn compelling example of tokenomics.

Hedging the State of Nature

I wrote last week that the central project of crypto is to use incentives to transcend the state of nature. But the war of all against all has long been a common attribute of the financial markets. Wherever there has been profit, there has been plunder. Crypto is not the first market to have to manage risk.

And at each turn, humans have had to invent new ways to hedge our risk. It’s why we first created insurance.

But insurance has been slow to emerge in the global DeFi markets. Maybe that’s because we believe lines will only go up. But maybe it’s also because compared to gambling on ape pictures insurance seems boring.

One of my best friends in San Francisco works for an insurance company. I do my best to feign interest when he talks about the economics of the industry, but honestly — it’s insurance. I’m sorry, Sanjay, it’s mind numbingly boring. And I’m someone that reads physics books for fun.

But crypto has a way of making staid institutions newly fascinating. Each new decentralized protocol requires the delicate orchestration of independent actors. It's a dance of incentives and counter-incentives. True DAOs, when they enable humans to profit from achieving a collective good, can be a thing of beauty.

This isn't what we see in most DAOs today.

Most DAOs are just companies with tokens. That’s fine. DAOs as skeuomorphic corporations are a necessary step in our tech adoption cycle.

But once in a while you come across a DAO that does something new, something that would have been impossible to achieve before. And when you do, it's a rush.

And that’s how I found myself spending a Friday enthralled by a decentralized answer to insurance called Nexus Mutual.

A Brief History of the Insurance Market (feat. Coffee)

The history of insurance is inseparable from commerce. In the beginning, we traded within our community and that was relatively safe. But soon we wanted new markets. We traveled over land or sea to sell our wares to other cities. But travel brought risks like bandits and shipwrecks.

In ancient Babylon, Hammurabi’s Code absolved merchants of their debts if their goods were stolen. By 1000 BC, insurance contracts were common in Ancient Greece.

In the age of exploration, European merchants traveled across treacherous seas to America and Asia. Just as these ventures had required the joint stock corporation to manage investors, they required a new tool for managing risk. They created that tool in the hottest hangout of the day - the coffee house. If 1980s bankers had cocaine, 1680s merchants had coffee. And the hottest bean dealer in London was Lloyd's Coffee House. Merchants and sailors gathered there to share news on adventures and perils. Overtime, this news was used to manage risk and set the price of insurance contracts. Lloyd's Coffee House would become Lloyd’s of London, the world’s first large-scale insurance market.

And, in each new era - new commercial ventures necessitated new insurance.

In the era of industrialization, factory dangers necessitated workman's compensation insurance.

In the era of Big Banks, investors created hedges to insure their primary investments against losses.

In the digital era, we created new insurance products to protect against hacks.

We’re a greedy species. But we hate risk. And that brings us up to the newest risky investment strategy - crypto.

Insurance Decentralized!

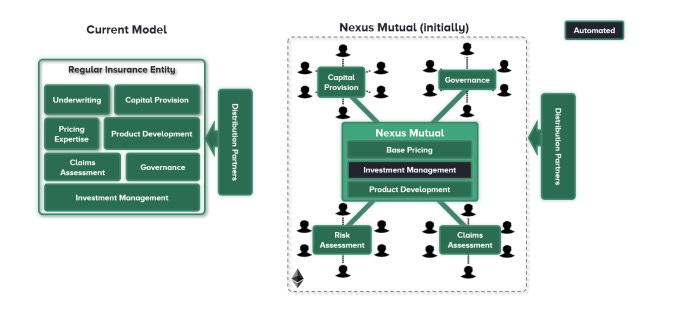

While new markets have necessitated new insurance policies, the market has been really stable since the 19th century. But the strategy being pursued by Nexus could be as disruptive to the space as Lloyd’s Coffee House.

Here’s the thing, the existing insurance market has a few problems.

First, insurance companies are often slow to figure out how to offer products for new industries with unknown risk profiles.

Next, the modern insurance company has an adversarial relationship with its customers. Customers want to pay as little as they can for insurance and receive as much pay out as possible. Insurers want to receive as much as they can in premiums and pay out as little as possible. This adversarial relationship necessitates expensive verification. In 2019, Oliver Wyman estimated that a typical insurance company will spend 35% of their revenue for verification and other frictional costs.

For a global market valued at $5 Trillion in premiums in 2021, that 35% operational cost represents quite an opportunity.

But it’s a tall order to improve on those inefficiencies. And as always, it’s worth asking if crypto is essential to the project.

What makes Nexus so exciting is that it leverages tokenomics in compelling ways. It's difficult to imagine a non-blockchain solution achieving what Nexus can.

To paraphrase Ben Wyatt from Parks and Recreation: “It’s all about the tokens.”

The Nexus Mutual Model

Enter the Mutual.

Drawing on notions of mutual support invented in ancient Greece, Nexus Mutual adapts the insurance co-op for crypto. Historically, people would create co-ops that depended on trust from shared history. Nexus, on the other hand, depends on a token and shared incentives to bind its collective.

In this way, it’s not different from many other groups that dot the cryptoverse. But where Nexus distinguishes itself is in how it uses this token. It illustrates how tokens - as a hybrid of money and equity - can serve as financing tool, incentive aligner and prediction market leverage.

Setting up the DAO/MCR

The first thing you need to run an insurance operation is a pool of capital so you can pay out claims. The lowest amount needed to operate is known as the Minimum Capital Requirement or MCR.

To raise this capital, Nexus sells “membership tokens” to the Mutual. The tokens entitle members to governance and profit-sharing. Nexus sells them at a price that fluctuates depending on how close it is to the MCR. If the Mutual is far below the MCR, it sells tokens at a heavy discount. If it is above the threshold, the tokens are more expensive. This encourages investors to provide capital when it's most needed.

The approach has allowed the protocol to raise >$300M USD in capital at the time of writing.

Evaluating Risk/New Markets

But the tokens are not only an investment stake. They are essential to the operation of the Mutual.

A core challenge with insuring anything in cryptoland is that the risks are so unknown. There are technical risks from exploiting code vulnerabilities in the smart contract. There are incentive-design risks that allow someone to "game" the contract to extract value.

Typical insurance companies can rely on historical data to accurately assess risk. Crypto-insurers have no such luxury. So they turn to a different approach — that may look familiar to those of you who have read about Gnosis.

Mutual members “stake” tokens to bet on whether a covered "smart contract" is secure. Their bets express confidence in the contract. If a successful claim is ultimately filed, the staker forfeits their claim. But if the contract is actually secure, the staker receives tokens as a reward for their successful bet. This bet allows the mutual to lower the price they charge premium holders. The prediction market provides an incentive for stakers to determine actual risk. And, in the event of a claim, their stake helps offset the amount the mutual must pay out.

Claims Adjudication and Staking

A classic problem in insurance is the risk of collusion between the claim-filer and the claim-assessor.

Imagine that I am deciding on your insurance claim for $1M. If you offer to pay me $500k, I'm going to be seriously tempted to decide a claim in your favor.

So how can the Mutual be confident that a member isn't bribing their way to a payday?

Sounds like a challenge for crypto-incentive design! Much like Proof-of-Work or other sybil resistant systems, we need a way to find a consensus on whether a claim should be paid.

Nexus solves this by adapting a proof-of-stake system common to modern blockchains. When a claim is filed, Nexus asks assessors to decide if it should be paid out. To participate as a claims assessor, Mutual members need to stake their tokens. These tokens serve as collateral.

If the member votes with the consensus decision on the claim, then they are rewarded with more Nexus tokens. If they vote against the consensus, they receive no tokens. And in the event that they are found to be acting in bad faith, their stake will be burned.

This ensures that voters are incentivized to cooperate and penalized for cheating.

Future: A Market for Actively Managed Insurance Investments

Proof of stake systems lend themselves to individual actors pooling their stakes together. But to profit in Nexus's system, a stake is necessary but not sufficient. To profit from risk assessment and claims assessment, you also need expertise.

This, in turn, incentivizes Nexus members to find experts to act on their behalf. And this is exactly what Nexus will enable with their syndicate system when it launches. Investors will be able to delegate their tokens to syndicates who can evaluate risks and claims.

These syndicates will benefit in proportion to the scale of capital they manage. So they will need to compete for that capital by demonstrating their ability to accurately assess risk. This creates a massive incentive for accurate risk assessment.

As Nexus scales to cover more and more contracts, their markets will provide a powerful transparent signal of risk to would-be buyers. This degree of transparency will allow crypto investors to choose exactly how much risk they can tolerate.

In doing so, it's going to incentivize safer contract design. And it will ensure that only the true risk-seekers need to be exposed to crypto's state of nature.