Web3's Favorite Public Goods: Catching Up on Gitcoin $3M+ GR15

The public good problem in open source. How Web3 uses Gitcoin to invest in WAGMI. A few favorites from GR15.

I don’t know if you know this, Anon, but the internet is a seedy, exploitative wasteland.

There’s no free lunch here. No ethics, either. As the Fred Again song goes: “There ain’t no love in the jungle.”

We spend our time in surveillance capitalism apps accessed through devices built with forced-labor. It’s a market wrapped in a morality fable: lofty pronouncements about freedom and connection that gave way to raw commercial rot.

But if, indeed, the internet’s business is rotten, it’s not rotten to the core.

If there is one place where the dreams of the 80s and 90s never died, it’s in the infrastructure of the web. The servers run on open-source software built and distributed freely. The programs are written on programming languages and frameworks that are freely developed and distributed, too.

Ever since Linus Torvalds uploaded the Linux kernel in 1991, the open source revolution has powered and inspired the work of our greatest hackers.

This is the paradox of the modern web.

Capitalism exists at the user-facing level of software. But it is built on a foundation of freely distributed public goods. It’s as if Central Park was used to serve you painstakingly targeted ads.

That’s because the problem with public goods is that they don’t make money. (I’m here for all your tautological needs).

Talented developers might build open source software out of altruism, or the joy of problem solving, or for reputation signaling or even in the hopes of selling “premium” services on top. But ultimately, without proven sustainable mechanisms for funding, public goods suffer from chronic underinvestment.

If you’re not the customer, and you’re also not the product, how do we pay for the damn service?

Crypto, however, offers a tantalizing possibility for coordinating public good investment. Because the ecosystem is so tightly knitted and so dependent on open protocols, there is clear economic value in firms collectively-investing in shared ecosystem infrastructure. Because each developer owns a token-stake in the success of the broader ecosystem, the system is inherently positive sum.

We’re All Gonna Make It, Indeed.

Ethereum holders want to support the development of killer-apps and NFTs on their chain, for example. NFT developers want more folks to know what NFTs are and why they matter. Eth protocol builders want developers who build on EVM. Both are served by investing in the broader system.

This opens the door to phenomenal new investments in public goods and infrastructure. And Gitcoin is the preferred tool of public good funders large and small.

The platform enables any developer to put-up a “grant request” asking for community funding for a specific project that has public value. It’s like a Kickstarter for crypto public goods. In and of itself, that’s nice, but it would still favor the interests of the rich.

Wealthy people giving only to the causes they care about is how SF ends up with a world class symphony and also world class poverty. Look – I’m no effective altruist. But I still think there’s room to improve our provision of public goods. What we want is a platform that optimally distributes resources to the public goods that people care most about for future development. And that is where Gitcoin really shines.

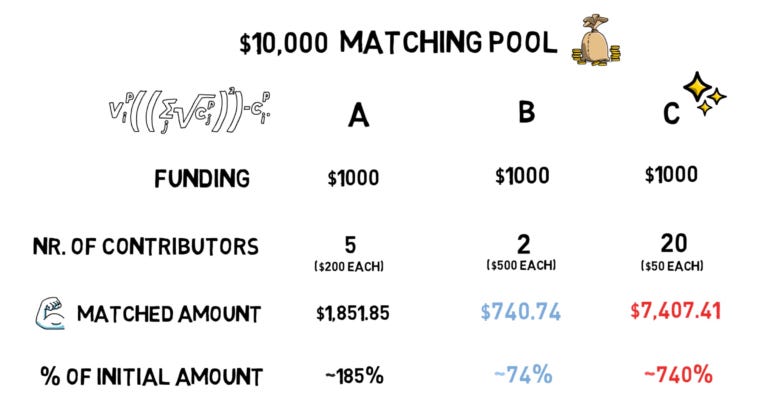

Gitcoin’s Grant Rounds make use of a concept called quadratic funding. QF allows ecosystem sponsors to optimize public good funding by steering grants to the projects that are most desired by the community. QF prioritizes matching funds to projects that have received the most donations (rather than just those that have raised the most). Here’s an example:

This past week, Gitcoin closed its GR15 – their signature grant funding. I found myself exploring the projects because, rather than just covering the crypto ecosystem, Gitcoin had branched into funding initiatives in areas traditionally overlooked by market-economies– DeSci (links), Climate/Sustainability and DEI.

This is not purely altruistic. The crypto ecosystem could benefit from becoming both more friendly to sustainability and non-white-crypto-bro-males. DeSci also could provide a significant credibility boost for an ecosystem that can sometimes appear to be light on substance. But the magic of Gitcoin is its ability to channel that collective self-interest into investments in meaningful public goods.

So I thought it would be fun to take a look at a few of the best projects in these categories to get a preview of the types of initiatives a crypto-native system might create for funding public goods for humanity.

My criteria for best: totally subjective. My analysis: moderately valuable.

Let’s go.

(Amount raised taken from a snapshot last week ~24 hours before event closed)

New Atlantis - Foundations of an Ocean Biodiversity Credit Market

$3,086

raised from 280 contributors

+$82,715

estimated QF matching

In 2015, the UN set 17 Sustainable Development Goals to promote sustainable economic development. Goal 14, targeted for 2030, aims to protect the world’s oceanic resources. The goal notes that over 3B people depend on the ocean for their livelihood and the entire planet depends on a healthy marine ecosystem to regulate temperatures. To achieve targets for sustainability, the UN estimates that 30% of the world’s oceans will need to be Marine Protected Areas by 2030. Today, that number is 2.4%.

The New Atlantis DAO is focused on creating a market that will reward the protection of marine resources. Patterned off of carbon credits, the DAO envisions a market for companies and nations to trade marine-protected-area credits, much like they trade carbon credits today. But to achieve that, they want to solve an issue that has confounded carbon credits – accurate measurement. So the group is raising funds to continue development of machine-learning pipelines that can use genomic samples of seawater to determine the relative health and sustainability of MPAs. If they succeed, these measured MPAs can be used to create a trustable unit for MPA credits that can be traded on open-exchanges. It’s a big swing, and the demand for purchasing ocean credits is uncertain today, but if they are successful, the impact promises to be huge.

TalentDAO

$1,731

raised from 232 contributors

+$51,163

estimated QF matching

Readers of this newsletter know that I’m bullish on the ability of Web3 to rebuild our basic science infrastructure. TalentDAO is aiming to do just that. The team is developing a protocol for any group to publish its own peer-reviewed journal. And, in a nice bit of meta/fractal/eat-your-own-dogfood culture, they are starting with the Journal of Decentralized Work, that studies optimal structures for decentralized work in DAOs.

MECXDAO

$5,485

raised from 229 contributors

+$25,679

estimated QF matching

Crypto, as you might have heard, has a “white men” problem. The problematic fan boys who tweet “Have fun staying poor!” at every skeptic are not exactly the best ambassadors for a movement that hopes to correct for global economic disparities. Enter Mec Zilla.

Mec built a following on Clubhouse hosting long AMAs on Web3. She has taught the experts about NFTs, and become a go-to for politicans curious about the space. Now she has turned her sights on bringing the “next 10,000 non white guys” into the space. Her DAO is focused on creating video content (built on top of their already developed curricula) to teach Web3 to traditionally marginalized communities and develop a census tracking the on-boarding of these communities into Web3.

A Few Other Favorites I Found Compelling (in no particular order):

Ethereum Ecosystem

Climate

DeSci

DEI