DAOs, but make it charity.

Ukraine. PhilanthropyDAOs. Elon Musk's Brother. And lots of new ways to change the world.

Hi friends!

I was at dinner on Friday with two friends when the topic of NFTs came up.

“Even if we like crypto, we should be able to agree that 95% of the shit that is happening is a scam,” said one of my companions.

Crypto, like other financial tools, does tend to bring out the unsavory sides of our humanity like greed and gluttony. The NYPost clearly agrees:

But financial tools also help us to build things, and they can help empower people to live better lives. So this week, I wanted to take a look at how DAOs are shaking up the way we practice altruism. I wanted to study the first wave of philanthropy DAOs.

Let’s dive in.

To Kiev with BTC

Russian sanctions were a gut-check moment for the crypto community. The blockchain opens possibilities of going around governments.

That can be good when it removes inefficiency or hurdles to innovation.

But it can also be really, really bad when it provides a way to undermine legitimate sanctions.

In the first days of the war, we learned that, yes, oligarchs were using crypto to avoid sanctions. But surprisingly crypto seemed to be a tool for the "good guys", as well. Even though they were not sanctioned. What gives?

The war made the Ukrainian banking system increasingly inaccessible. But the blockchain allowed Ukrainians to continue transacting. It also enabled allies from around the globe to donate instantly.

Thus far in Charterless we focused on how DAOs change for-profit enterprises. But their power is more generalizable. DAOs have the power to make philanthropy more representative, more nimble and more accountable.

Trends in Philanthropy

Despite a reputation for inertia, charity has actually changed a lot in the last decade. Millennials, it seems, do more than just shift demand for chain restaurants. They have forced charities to change their MO.

The Millennial Impact Report and Fidelity's Future of Philanthropy capture a few ways that GenY-and-Z are different:

They expect to be involved. Millennials and Gen-Z view contributions of time, money and voice as equally important. They want to offer all three.

They give in response to social media. 46% reported donating to a cause via a social media platform. 43% say they encourage friends and family to donate when they do. 46% say they are more likely to give if a coworker does.

They care about causes, not institutions. 90% give based on the cause rather than to a specific organization. They view both giving and changing consumption as effective tools.

Crypto-altruists are not immune from these generational trends. In fact, they are pushing the frontiers on all three.

And it would probably make sense for the traditional philanthropy sector to pay attention because, as Willie Sutton once said when asked why he robbed banks, “Because that’s where the money is.” According to the Giving Block, 45% of crypto users donated at least $1,000 to charity in 2020. Their average gift size was $11,000, 100x the typical online donation.

Community Involvement: BigGreenDAO and Quadratic Funding

Though well-meaning, non-profit leadership teams are often out of touch with their communities. Only 49% of nonprofit CEOs thought their board could build trust with their community.

That’s a real problem.

How can an organization hope to effectively serve a community that doesn't trust it?

It can't.

But we can redesign these organizations to represent donors and the broader community.

Consider the BigGreenDAO project, founded by Kimbal Musk (brother of the Twitter guy).

The BigGreen nonprofit sponsors community vegetable gardens. Musk, the group's co-founder, launched the BigGreenDAO as an experiment. What if, he wondered, donors and peer non-profits could help them choose the best projects?

Here’s how it works:

BigGreen, and five other nonprofits chosen by the DAO, pre-screen applicants to make sure they are a good fit.

Any donor to the BigGreenDAO receives a single $GARDEN governance token. Past grantees also receive a token.

Donors use these tokens to vote on which projects should receive funding.

The amount of funding is determined using quadratic funding (more on this in a moment).

For donors, this offers transparency and influence.

For the served community, it offers a broader set of perspectives (hopefully) leading to better outcomes.

For BigGreen, it has a sneaky secondary benefit. We all know that people love to post about their charitable deeds on social media. They also love to campaign for their favored causes.

So it’s easy to imagine both the potential grantees and the DAO’s donors soliciting feedback and campaigning online. These posts will draw in other interested donors. The DAO has built-in virality.

Even the chosen funding system -- Quadratic Funding -- has a viral component. QF has become quite popular in DAOs so it's worth summarizing:

Imagine that Sarah is a wealthy donor who loves BigGreen. She agrees to match any donation that her friends make to the organization.

Sarah has two friends, Jack and Mike, that are considering giving. Imagine that between them, they will give $100. In traditional matching programs, it doesn’t matter if Jack and Mike both give $50 or if one gives $100 and the other $0. Either way, Sarah will match $100 in donations.

Quadratic funding is different. Sarah actually pays a different amount depending on how many people give. If Jack’s donation is J and Mike’s donation is M then Sarah will give (√(J) + √(M))^2.

In the case of just Jack donating $100, Sarah gives $100. But if Jack and Mike both give $50, then Sarah would give $200.

This approach ensures that a donation is more powerful if more people agree to give.

It ensures that the funded proposals are popular with people, as well as wealthy donors. It also offers yet another reason for donors to encourage friends to give.

Guerilla Charity – Giving at the Speed of Social

There used to be signs on the walls at Facebook that read, “The invisible victim is the world’s biggest problem.”

Social media, we hoped, could play a critical role in helping surface and solve major problems.

And, despite its problems, there's little doubt that social media has surfaced problems.

The Arab Spring. Black Lives Matter. Ukraine. Social media spreads awareness of suffering around the world with unparalleled speed.

But the trade-off (and it's a real one!) is that this seems to have broken something in our brains.

The human mind was never meant to empathize with the suffering of 6 Billion people at once. It evolved to help us care for ourselves, our families and our communities. Social media pushes the biological limits of our empathy.

Our exhausting reality gets compounded by our helplessness. Our tools for resolving injustice have stagnated. Our global aid infrastructure is not designed to deploy at the speed of viral tweets.

We see, we post, we send money to a big organization that might help and then we tune out. The problems stay in place.

But what if we could see an injustice and send money directly to the victims? What if we could cut the layers of middle men with operating costs and potential corruption to reach those in need?

That's the promise of DAOs. Imagine volunteers in, say a disaster area, creating a group treasury. They could raise money and disburse it immediately.

There are risks here (to be sure, and we will discuss them below), but there’s also tremendous opportunity.

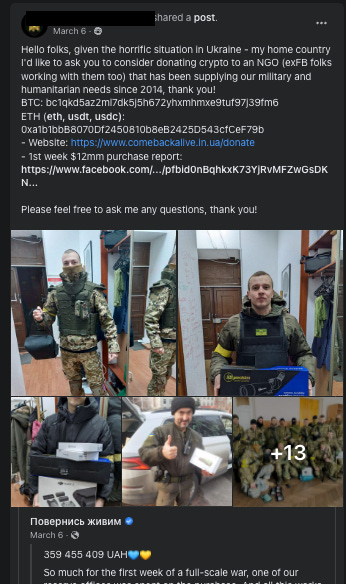

A recent post from an NGO in Ukraine highlights the possibilities.

post

I'm not sure how one would give to Ukrainian resistance groups before the War. But today, it's as easy as entering a BTC address. No fees. No wondering if the money got through.

GoFundMe was the first step in this revolution. But DAOs have other advantages. For one thing, they enable group accounts for shared use/accountability. For a second, they can sidestep transaction and currency conversion fees.

But most importantly - they have an entire ecosystem with which they can integrate. From investing endowments to on-chain voting and on-chain transaction histories. They can go from idea to organization in seconds.

The internet long ago made us aware of hidden problems. But now, we're getting better tools to do something about it.

Flexible Structures

The nonprofit organization is not the only way we give. Today, impact investing and shifting consumer behavior are just as popular as donating.

These secular trends were already in effect before crypto. But DAOs – which already exist in a regulatory gray area – can speed up these trends. They are already flexible enough to accommodate whichever tactics are most effective.

Consider two non-traditional “philanthropy” initiatives emerging from the crypto community.

ClimateDAO has productized the shareholder activism campaign. Members buy tokens from the DAO in exchange for their Bitcoin and Ethereum. As the DAO’s treasury grows, members will pick a company to target for an activist investor campaign. The hope is that they raise enough to force the company to take on ESG targets. It's easy to imagine this model catching on. A CoalDAO or a gun manufacturer DAO could target companies for shutdown. We're used to hearing about boycotts, but shareholder campaigns could become as common.

Meanwhile, PopcornDAO is, at root, a DeFi platform. Investors select a basket of active and passively managed crypto index funds. But, on Popcorn investors also agree to allocate their “management fee” to the DAO. The DAO’s members then vote on charitable organizations to whom they can donate these fees. It's an investment platform for social good. It’s definitely not a non-profit. But it is going to do a lot of good in the world.

Transparency and Accountability

Look I'm not that naive. We regulated the nonprofit space for a reason. When we make it easier to set up legitimate organizations, we also make it easier to set up fraudulent ones. When we introduce new ways to give, we introduce new abuse vectors.

If we're going to realize the potential benefits, we need to make these groups trustworthy.

That's easier said than done.

Trustworthiness via Social Proof

Deregulation has a cost.

We have forfeited the institutional safeguards that we trust to prevent abuse. In their place, we need to embrace older systems of credibility.

Once again: let's look at Ukraine.

On March 11, the Ukrainian government asked for BTC donations on Twitter. To be sure, this looked like a scam or worse.

But Ukraine's ambassador reached out to Vitalik Buterin to confirm its veracity. With Vitalik vouching for them, donations poured in. To date, the effort raised over $60M USD.

Social credit from trusted validators is as good as gold in the cryptoverse.

Accountability

Of course, outright fraud is not the only risk for donors. There’s also the very real chance that your donation doesn’t achieve anything.

The best checks we have against that are transparency and rewarding good performance. That’s kind of the bread and butter of the blockchain and DAOs.

DAOs tend toward openness. Every decision and every transaction are written on-chain. So all of a group's records are visible and verifiable by anyone with an internet connection.

Transparency is not a buzz-word, it is the entire project of crypto.

Accountability, too, can be baked into the tools.

Using smart contracts, DAOs can now encode results-based bounties for specific charitable outcomes. When an organization achieves a milestone, like planting trees for decarbonization, a DAO can pay them automatically.

This opens the space of possible contributors. DAOs no longer need to only work with trusted partners. They can rely on properly incentivized validators to assert that the result has been achieved. Contributors can also be sure their acts will be immediately compensated.

Taken together, we can see that the future of philanthropy will be pretty different. Large, detached charities are going to be a relic. In their place will arise new organizations that are faster, more representative and more accountable.

For the sake of our world and our sanity, we all better hope that that future comes soon.